By Laura Temple, Communications Consultant, USSEC

Inflation, the war in Ukraine and pushes toward clean energy are among the issues influencing the worldwide vegetable oil supply, according to Matt Ammermann, commodity risk manager and vice president, Eastern Europe/Black Sea Region for StoneX Financial.

Ammerman discussed factors he believes are influencing the commodity environment and squeezing the global vegetable oil supply at Soy Connext, the global U.S. Soy summit attended by more than 600 members of the soy supply chain from more than 60 countries.

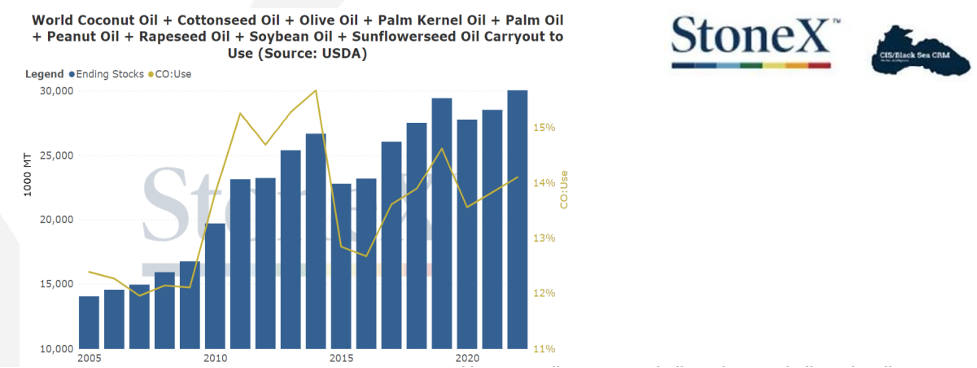

“Although global vegetable oil demand outstrips current supply, supply is increasing faster than demand,” he said. “As a result, we forecast record ending stocks for the end of this year.”

He added that inflation has caused economic chaos globally. With this uncertainty as a backdrop, Ammermann explained different pressures impacting various segments within the vegetable oil market, including soybean oil, palm oil, sunflower oil and others.

Soy Oil

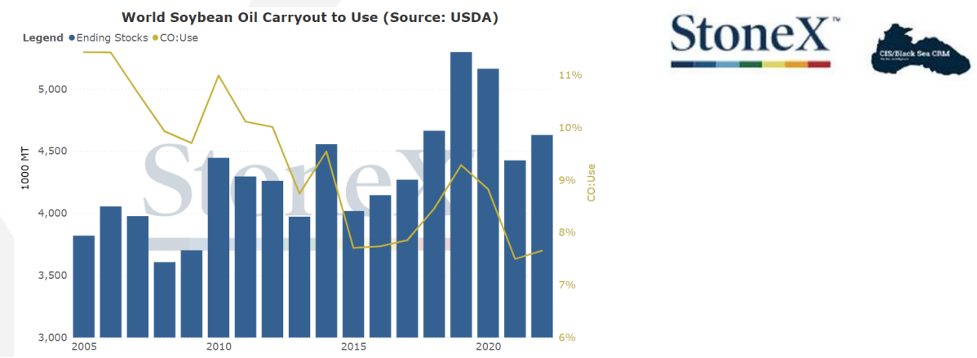

“The soybean oil market set a record for tightness last year in the ratio of carryout to use,” Ammerman said. “But, we forecast that the market will get even tighter in the coming year.”

He noted that the role of soybean oil as a biodiesel feedstock and U.S. policies that provide incentives for clean energy production could move the U.S. out of exporting soybean oil.

Other Oil Market Segments

The pictures differ for other types of vegetable oil, according to Ammermann.

- Global carryout for palm oil has reached record levels, according to USDA data. He said this is due largely to export restrictions and protectionist policies imposed by governments of major producing in response to the war in Ukraine.

- The war also forced the development of a land corridor to export sunflower seed oil through Bulgaria and Romania instead of Black Sea Region ports. The development of this export route means that overall regional exports are only down about 10% compared to before the war.

- The rapeseed oil market has remained relatively stable.

Trends

Ammermann described overall trends and context that will continue impacting the vegetable oil complex moving forward.

- Drought conditions in areas of Europe, the U.S. and China are feeding into the push for clean energy to mitigate climate change.

- High oil prices could disrupt biofuel expansion plans in countries like Indonesia.

- Though ships are moving in the Black Sea Region, they mainly are carrying corn and other grains. Oil exports will likely remain dependent on the land route and increased crush in other parts of Europe.

“Vegetable oil is a leading indicator for crude oil trends, as well,” Ammermann added. “There is a long-standing historical correlation where the crude oil market tends to follow a few months behind the vegetable oil market.”

The U.S. Soybean Export Council hosted Soy Connext Aug. 22-24 in San Diego, California, with the support of the soy checkoff. Trade teams of international customers visited U.S. Soy farms before and after the event. For more information and other highlights from Soy Connext, visit ussec.org or soyconnext.ussec.org.

This article is partially funded by U.S. Soy farmers, their checkoff and the soy value chain.