February 2021 WASDE: Soy Supply Remains Tight as Exports Continue to Rise

- Category:

- Virtual Events

The U.S. Soybean Export Council hosted its monthly World Agricultural Supply and Demand (WASDE) briefing on February 9. As they do each month, market analysts provided an in-depth look at the U.S. Department of Agriculture’s (USDA) February 2021 WASDE as it relates to U.S. Soy. United Soybean Board (USB) and USSEC VP of Market Intelligence Mac Marshall was joined by trader and analyst Michael Liautaud, Manager, Education & Research at Commodity & Ingredient Hedging, LLC.

February Key Revisions

Marshall began with a look at key revisions to the February soy complex. He pointed out that on the U.S. side, exports were revised by 20 million bushels up to 61.2 million metric tons (MMT), the highest estimate since November 2017 and ending stocks were revised downwards by 20 million bushels to 3.3 MMT or approximately 10 days’ use. Soybean meal and oil prices rose and soybean oil for biodiesel use also rose.

On the international side, world ending stocks were revised downward to 83.36 MMT, driven by reduction in 2019/20 ending stocks for Argentina, Brazil, and Paraguay. There were no revisions, however, to Brazilian or Argentine production.

Tightening Inventories

“The prevailing market view was that USDA would cut ending stocks for the U.S. – and naturally, that happened,” stated Marshall. “That was the major part of today’s report.”

“The key variable driving this continued reduction in ending stocks has been exports,” Marshall explained.

Liautaud’s Take

Liautaud also weighed in on the February WASDE, discussing South American production and Chinese demand.

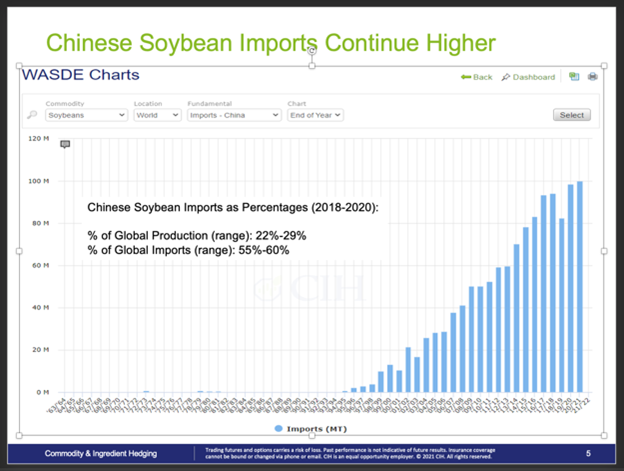

“I think it’s important to understand that [Chinese] influence in the marketplace is a real thing,” Liautaud stated. Over the last three years, he reported that China has imported between 22 and 29% of all global soybeans. China’s demand influences U.S. prices, he said, and while the U.S. and Brazil have similar prices, Liautaud believes that logistics and reliability give the U.S. an edge.

Reliable Supply

During a Q & A session, Marshall and Liautaud talked about bullish market conditions and Liautaud reiterated that price spikes are caused by scarcity. As U.S. soybean farmers look towards planting season, how will they interpret market signals?

Minnesota soybean farmer and USB director Rochelle Krusemark, who farms with her husband and son, keeps a sharp eye on market signals. She and her husband Brad have added winter small grain followed by seeding a forage grass to their crop rotation and added some land for the 2021 growing season, and “we will continue to plant the remaining acres 50/50 corn and soybeans.” Krusemark points out that developing a crop rotation plan helps manage weed control, fertility, and organic matter, which improve soil health. “Diversification of crops helps manage market risk,” she adds.

Krusemark says their son A.J. will plant more soybeans in 2021 than in 2020. “There was some land available to rent from the Department of Natural Resources (DNR) and because the contract stated soybeans or small grain, he will plant additional soybeans in 2021.”

Report Serves as Barometer

Liautaud and Marshall agreed that USDA’s WASDE is a “fair barometer for what to expect.”

To watch the USSEC February WASDE update in its entirety, please click here. For more information about U.S. Soy, please visit USSOY.org.