Opportunities for U.S. Soy in Sub-Saharan Africa Livestock Feed

- Category:

- Animal Utilization

- Virtual Events

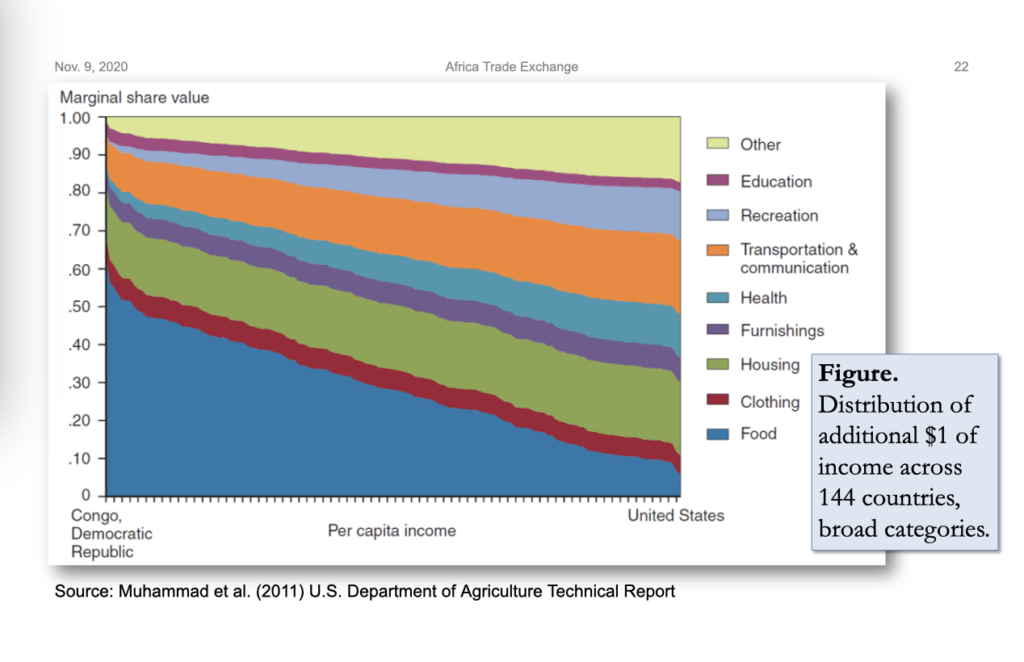

Africa’s population, growth and urbanization contribute to its up and coming market development. As expansion in the region continues, consumer preferences and purchasing habits begin to shift.

“Lower income countries tend to spend a lot more of their income on food,” Dr. Andrew Muhammad said. “But, there’s also this notion that as incomes rise in the developing world, diets transition from staples to animal protein.”

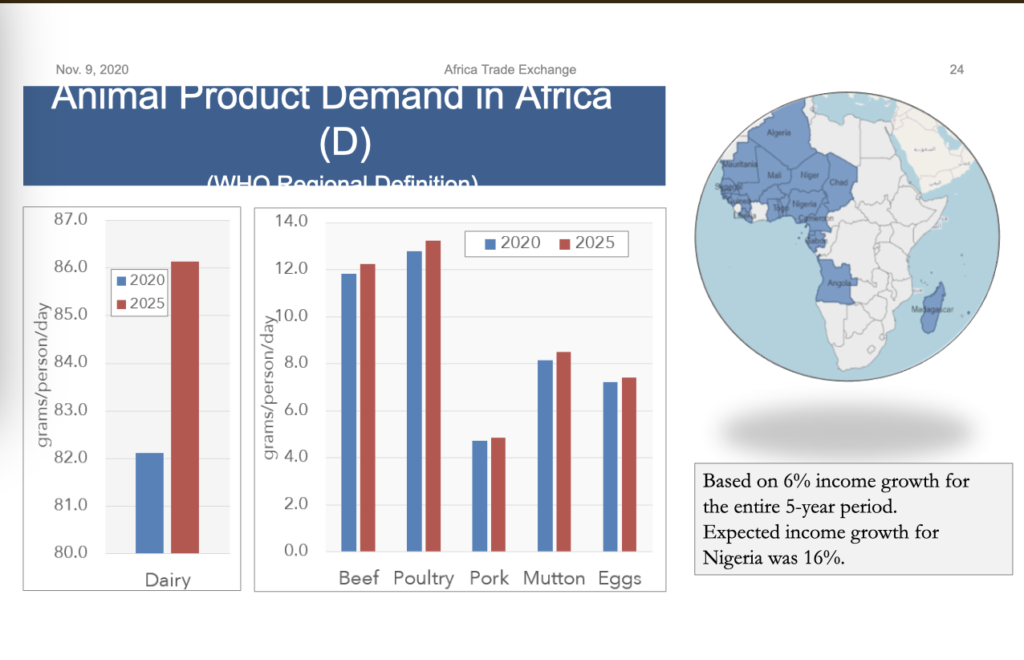

Muhammad obtained income forecasts for Sub-Saharan Arica and considered the estimated global relationship between income and animal product spending. From there, he derived changes in per capita intake of animal protein.

Over the next five years, shifting incomes and consumer preferences are expected to increase demand for livestock products, including dairy, beef, poultry, pork, mutton and eggs. This shift drives an upward trend in meat production in the region.

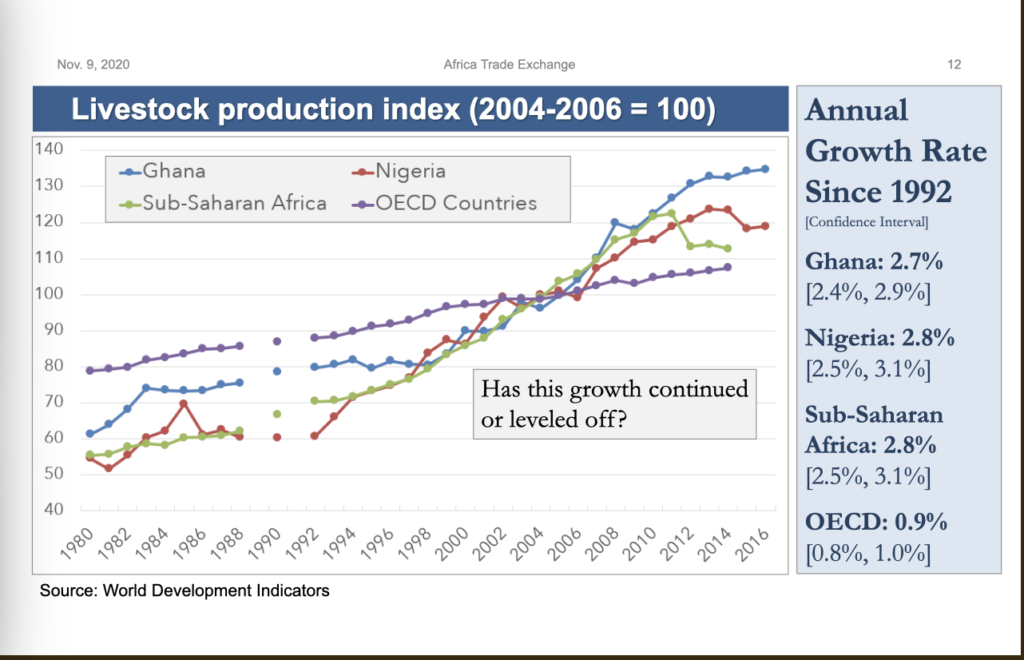

Annual livestock production has grown steadily in Sub-Saharan Africa. It has experienced just under 3% growth annually since 1992. The United States Department of Agriculture (USDA) projects a significant rise in production until 2029.

With this projected increase in production comes a potential increase in livestock feed demand, an area of interest for U.S. Soy.

Sub-Saharan Africa is currently the sixth largest destination of U.S. feed and grain exports, with Nigeria being the largest destination within the region.

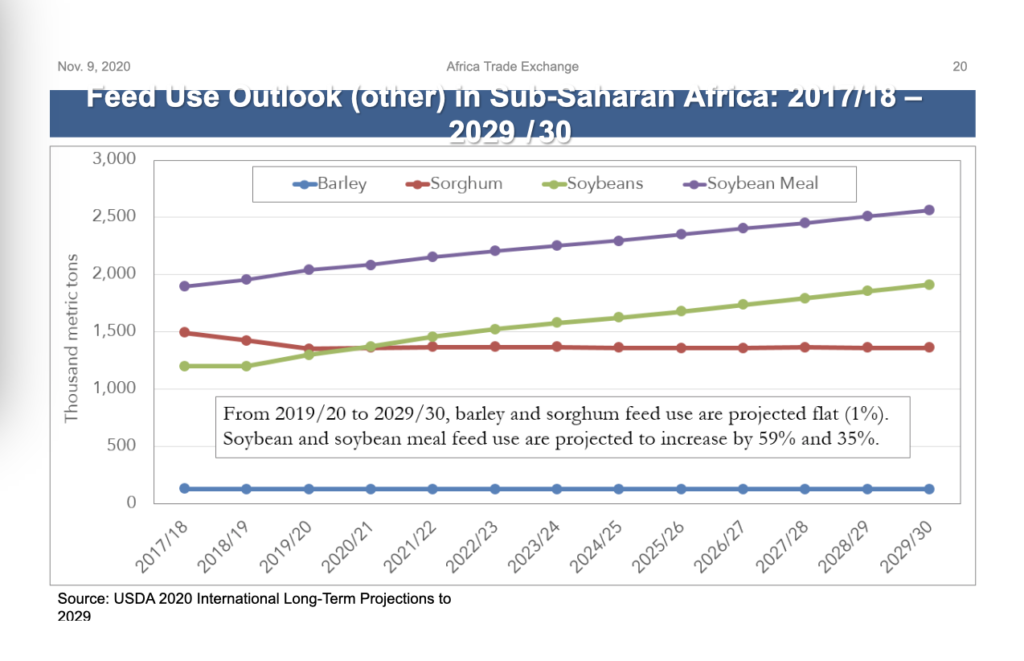

Over the next ten years, the region’s corn feed use is projected to increase by 19 percent.

“This is, in terms of volume, the largest of the feed grains,” Muhammad said.

Looking at other grains, the region ranks 51st as a destination for U.S Soy and soybean products. Though this number is lower than that of other feed and grain exports, it presents an opportunity for significant growth. Within the same ten-year span, soybean and soybean meal feed use are projected to increase by 59% and 35%, respectively, according to USDA.

This is the highest projected increase among feed use grains in the region and represents an opportunity for boosted demand of U.S. Soy.

This livestock outlook was one of many topics covered throughout the virtual African Trade Exchange Nov. 9 and 10. The U.S. Soybean Export Council partnered with the U.S. Grains Council and World Initiative for Soy in Human Health to host the event.

Participants had the opportunity to learn more about Africa, better understand efforts underway in the region and connect with those who may serve as a future resource, partner or friend. Sessions are available on-demand to those who register here.