Volatile. Uncertain. Complex. Ambiguous. These are all words business executives use to describe today’s operating environment, and the business of farming is no different. Being timely and managing risk allow U.S. Soy farmers to navigate these complexities. Learn why and how these strategies benefit international buyers.

As businesses around the world face increasing volatility and uncertainty, buyers of U.S. Soy might rest a little easier after the release of the U.S. Department of Agriculture’s March 31 Planting Intentions & Quarterly Stocks Report and hearing from U.S. farmers on their planting and risk management strategies during a webinar last night hosted by the U.S. Soybean Export Council (USSEC), with funding provided by the United Soybean Board.

“In an uncertain world, it’s important to look for supply chain partners who you can rely on,” said USSEC CEO Jim Sutter. “As you’ve witnessed in the past several years, even regional weather events have not impacted the availability of U.S. Soy. Our farmers are resilient, they are geographically diverse and they too are managing risks.”

With acreage planted to soy projected at a record 91 million acres, USDA’s Planting Intentions & Quarterly Stocks Report indicated that buyers can rely on U.S. Soy for an abundant supply moving into marketing year 2023. This is up 4% from 2021, which saw U.S. farmers plant 87.2 million acres to soy.

USDA Chief Economist Seth Meyer and Mac Marshall, Vice President of Market Intelligence for USSEC and the United Soybean Board agreed this was a shock for industry analysts.

“This is only the third time ever where acres planted to soy are more than corn,” Marshall noted. “The other years were 1983 and 2018.”

Increasing soybean acres will come at the expense of corn acres with planting projections at 89.5 million acres.

“I think trade analysts knew there would be an increase in soybean acres due to increased input costs, but these numbers and the magnitude are really a big shocker,” Meyer said.

Eight states are projected to plant record soybean acres, including: Illinois, Kentucky, Michigan, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin.

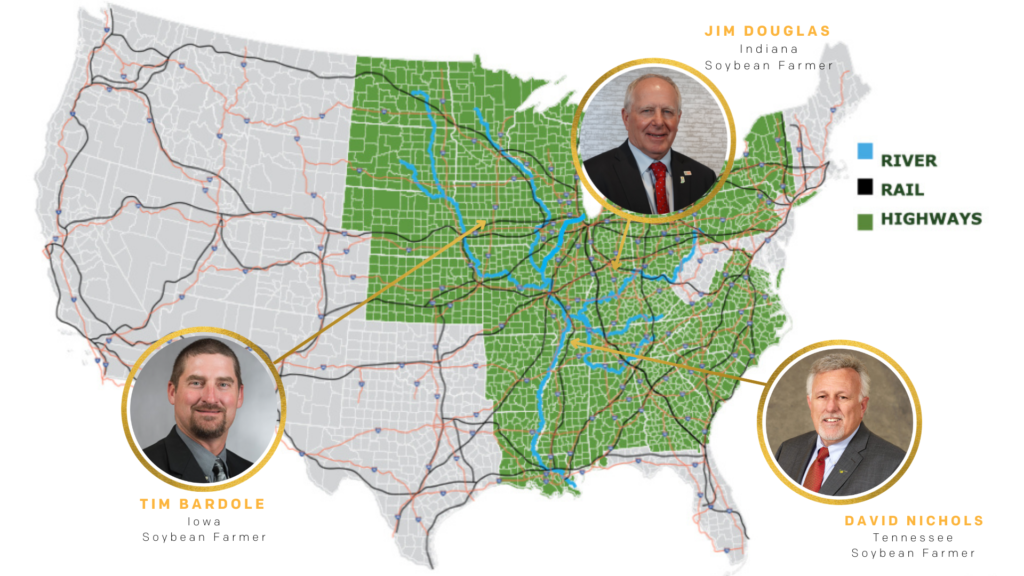

Helping to bring these numbers into perspective and for insight behind what will be planted in the ground for the 2022 crop year were Tim Bardole from Rippey, Iowa; Jim Douglas from Flat Rock, Indiana; and David Nichols from Ridgely, Tennessee.

“This year, we are just keeping with our normal rotation,” said Bardole, a fifth-generation farmer, who grows corn and soybeans and operates a 5,000-head finisher and 5,000-head nursery for hogs. “We will have a little more corn than soybeans.

“In this area, I don’t know anybody who is changing their rotations. The majority of fertilizer is already on for the corn … so [those acres are] pretty well set.”

But that’s not the case for Douglas, who is a fourth-generation farmer, and has some flex acres as planting approaches.

“We would like to grow about 60% corn and 40% beans, but if the planting season doesn’t work out, we have enough soybean seed on hand that we can go to a 50-50 rotation,” shared Douglas, who also raises wean-to-finish hogs. “My message to buyers is that farmers in the U.S. are geared up to plant this crop. It should be a successful season, so we should have ample supply to provide to everybody.”

One farmer who has deliberately increased soybean acres is Nichols, who is part of a fourth-generation farming family. They grow corn, soybeans and soft red winter wheat, as well as operate a seed dealership. Nichols explained that as you move farther south, planting soybeans is a way to remove some of the weather risk and offset input costs.

“We are up against tremendous input increases on that side of things for corn,” Nichols said. “In my operation, our corn acres are down from last year. In 2021, we planted about 50% corn. This year, we are going to be down to about 30% corn and replacing those acres with soybean acres.

“Our wheat acres are about the same year-in and year-out, but we did trim those acres a little bit because of nitrogen costs. When we were planning this crop back in the fall, we saw those input prices start to escalate and were reading reports that led us to believe this was fixing to be an issue. As it turns out it has been — even worse than expected. In this part of the country, soybean acres are definitely going to be up.”

Strategies to Minimize Risk

U.S. farmers deploy a number of strategies to minimize their risk, and no two operations or years are alike.

For the past two years, Bardole said they’ve started paying for fertilizer much earlier than normal. Last year at this time, he secured the anhydrous for the fall-applied nitrogen and not much later the phosphorus and potassium.

“Much of it is just watching the market and having the relationships on the supply side that you can depend on,” Bardole said. “We try not to change too much just because of one year. Also, we use of the Board of Trade to price the crop out into the future, limit risk on and know what we are working with.”

At Douglas Farms, they’ve invested in on-farm fuel, fertilizer and grain storage.

“I wasn’t thinking about this type of event to drive that, but we did think it was prudent to have those under control and have flexibility when you buy those inputs,” Douglas said. “Then with our hog operation, we’ve always considered it a diversification strategy on the income side, but I never thought it would be the value on the input side with the hog manure as fertilizer that it is now.”

Nichols added that one of the things that many farmers, himself included, use is crop insurance.

“By increasing our soybean acres this year, that’s one of those ways we are managing risks, and we are doing everything we can to be timely,” he said. “Being timely is one way to mitigate risk as well. We try to be as efficient and timely in getting this crop in and take care of it throughout the season as well.”

Uncertainty Demands Decisive Leadership

On full display was the decisive action and leadership of our U.S. Soy farmers.

“You can see U.S. farmers are reacting to market need,” noted Sutter. “At the national level, U.S. farmers will plant more soybean acres this year than ever before. We see the need. The market is calling for us to do that.

“And finally, we’ve talked about uncertainty – the importance of managing risk and volatility. Your employees, your investors, your customers, they need decisive leadership from you that doesn’t rely on business as usual.”

Sutter shared that there’s a global call for companies to mitigate the climate crisis and enable food and nutrition security around the world.

“U.S. Soy is at the table and partnering with organizations to help them achieve those goals – be it increasing animal protein availability, improving animal performance or shrinking the carbon footprint,” he said. “At a time like this when there’s so many issues to focus on, some think we shouldn’t worry about sustainability; however, nothing could be further from the truth.

“Farmers are still worrying about it, consumers are concerned about it, and inaction is not an answer. U.S. Soy is part of the largest sustainability verification scheme and can enable customers to achieve their sustainability and food and nutrition goals.”