USSEC recently took part in an international online conference, “Soybean and Meal Market,” organized by the Ukrainian company APK-Inform on Zoom. Conference presentations were held in two sections, “Ukraine’s Place in the Global Market of Soybean and Meals” and “Global Soybean Market: Between Politics and Economics.” The conference was attended by more than 200 people from Ukraine and neighboring countries.

At the invitation of the event organizers, USSEC consultant Dr. Jan van Eys, founder of GANS Inc., gave a presentation about world animal production and the critical role of U.S. Soy.

Ukrainian soybean production started to develop in the early 2000s and the Ukraine is currently the largest soybean producer in Europe. Based on the data of the State Statistical Service of Ukraine, the country produced a record crop of 4.46 million metric tons (MMT) of soybeans in 2018 with an average yield 2.58 metric tons (MT)/hectare and 3.7 MMT in 2019 with an average yield of 2.35 MT/hectare. In 2020, the production of soybeans in Ukraine is forecasted to decrease to 3.41 MMT.

According to the presentation of Oksana Prosolenko, Regional Director of the Donau Soja, Ukraine reduced its soybean production last season by 15.9%. This season, a decrease in sown area is also expected throughout Europe and Ukraine. Ukraine is again at risk of a decline in production of 7.6%. Prosolenko remarked that internal consumption of soybeans in the EU significantly exceeds the domestic supply of soybeans. Only 8% of soybean meal consumption is covered by domestically grown soybeans. The unique situation formed at the Ukrainian market this season characterized by a shortage of raw material supplies at local oilseed crushing facilities resulted in the growth of the import of soybeans to Ukraine with a total forecasted volume 30 thousand metric tons (TMT).

During the second section, Anderson Galvao, CEO, Celeres, discussed the key players of the global soybean market in his presentation. He stated that global demand for protein is under recovering. Weather issues have curbed the ability of soybean producers around the world to match robust global demand for the oilseed.

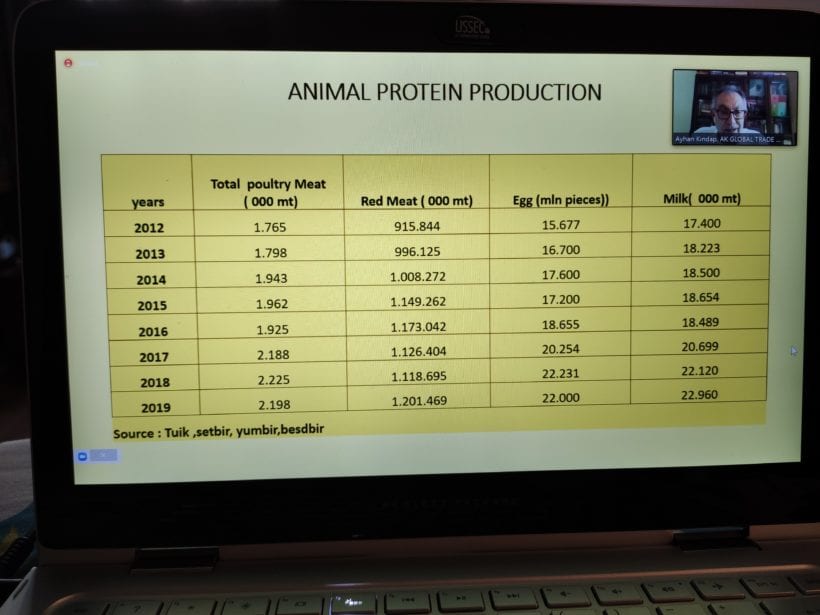

Ayhan Kindap, Managing Director and Founder of AK Global Trade and Consultancy said in his presentation that Turkey is a main importer of Ukrainian soybeans and meal. In 2019, about 1.16 MMT of Ukrainian soybeans were exported to Turkey. Based on the actual results from quality certificates, protein content of the Ukraine soybeans was lower than South American and U.S beans. He stated that while the proximity of Ukraine contributed favorably to Ukrainian exports to Turkey, the soybean quality was not comparable to soy from the U.S. and South America.

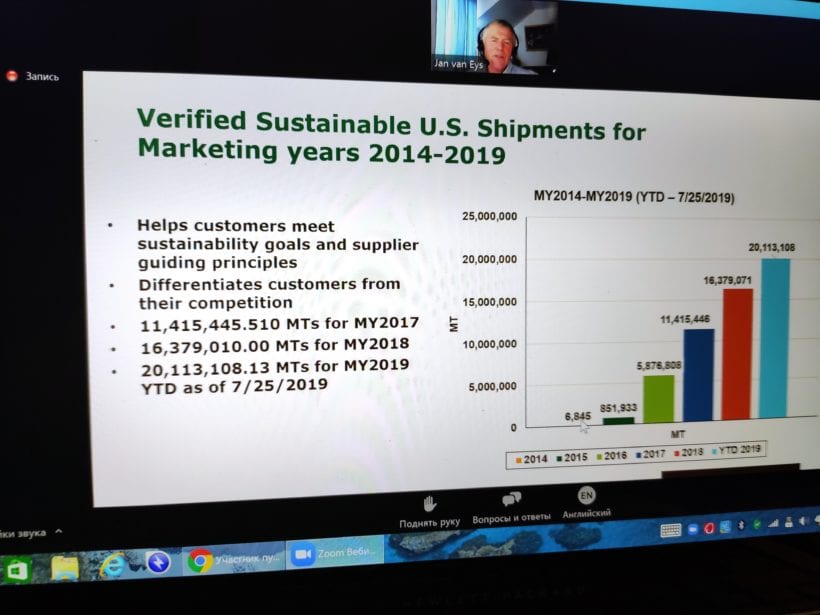

Dr. van Eys’ presentation, “World Animal Production: The Future and the Critical Role of U.S. Soy,” completed the conference. He provided not only an in-depth picture of the world animal production growth but also emphasized the importance of the development of a sustainable, science-based, agricultural/animal production policy and of sustainable soybean production. Dr. van Eys shared information on verified sustainable U.S. shipments for marketing years 2014 to 2019 that helped customers meet sustainability goals and differentiated customers from their competition. Event attendees received a clear message that U.S. Soy is an integral part of global feed and animal production and it is sustainable.