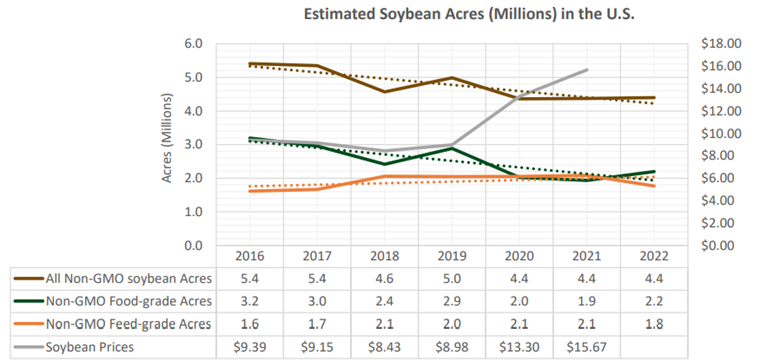

USSEC recently released a study, funded in part by the soy checkoff, investigating non-GMO, food-grade soybean acreage across the U.S., expanding on information available from USDA. The study estimates that U.S. Soy farmers raised about 1.7 million acres of contracted non-GMO acres of non-GMO soy food beans in 2022, as well as about 2.1 million acres of non-GMO feed-grade soybeans.

The Non-GMO Food-Grade Soybeans Quantification Study attributes the trend of declining U.S. non-GMO soy food bean production to several factors including high commodity soybean prices, perceived yield lag, premium levels, agronomic challenges, disruptions in shipping and freight costs. The study is based on interviews and online surveys from non-GMO soybean producers, and companies that purchase food and feed grade soybeans, three state soybean boards and three industry experts.

“The results suggest that the lower non-GMO soy production in the U.S. is caused by the supply side,” says Will McNair, director of oil and soy food programs and deputy director of Northeast Asia for USSEC. “Through the study, purchasers indicated that demand is there and growing, but with current commodity prices, as well as other factors, farmers and have less interest in raising and managing non-GMO and other identity preserved (IP) soybeans as there is less economic value in them doing so.”

For farmers, current non-GMO food-grade premiums haven’t paralleled commodity prices. In 2021, soybean commodity prices increased by about 48%, while premiums for soy food beans increased just 4%. In 2022, commodity prices increased about 18%, compared to 13% for non-GMO food-grade soybeans.

As commodity prices descend, this trend may shift, but soybean farmers point to yield drag and weed control issues as agronomic challenges they consider when deciding to raise non-GMO soy food beans.

In addition to understanding current acreage trends, the study noted factors that could increase production. Farmers noted that higher-yielding varieties and minimum price guarantees would influence their decisions planting decisions. Purchasers agreed with these factors and added that resolving shipping and freight issues would also help.

“Study participants in the supply chain said that market signals from upstream purchasers would help increase soy food bean supply,” McNair shares. “Recurring comments focused on contracting acres, higher premiums, better freight costs and delivery periods.”

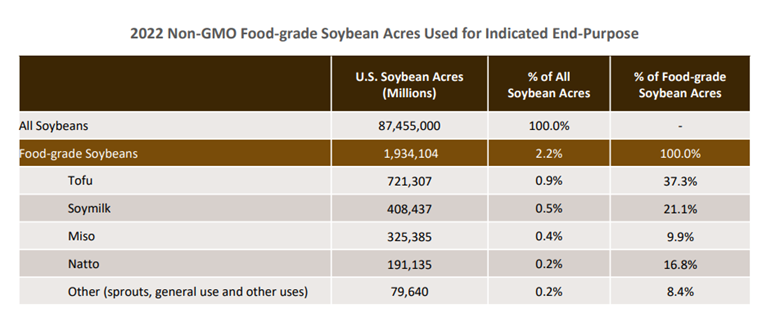

The study estimates that contracted acres account for about 88% of the total non-GMO soy food bean production in the U.S. These soybeans are destined for tofu, soymilk, natto, miso and other markets.

“These insights into soy food bean supply help USSEC members and U.S. Soy customers understand production trends,” McNair explains. “They can also inform efforts to increase the supply of non-GMO soybeans raised for soy food production. I encourage all those involved in the industry to use the Non-GMO Food-Grade Soybeans Quantification Study as a tool to inform future planning.”

This story was partially funded by U.S. Soy farmers, their checkoff and the soy value chain.