Consumer demand for sustainability is a pressing consideration when sourcing soy. U.S. Soy takes this issue very seriously and as demand for safe, sustainable products continues to rise globally, the U.S. soy industry stands at the ready.

The sustainability story of U.S. Soy was one of several key messages shared during the virtual 2020 U.S. Soy Global Trade Exchange and Specialty Grains Conference, which brought together more than 1,500 buyers and sellers representing nearly 70 countries to learn more about the competitive advantage that represents U.S. Soy.

U.S. Soy’s Carbon Footprint

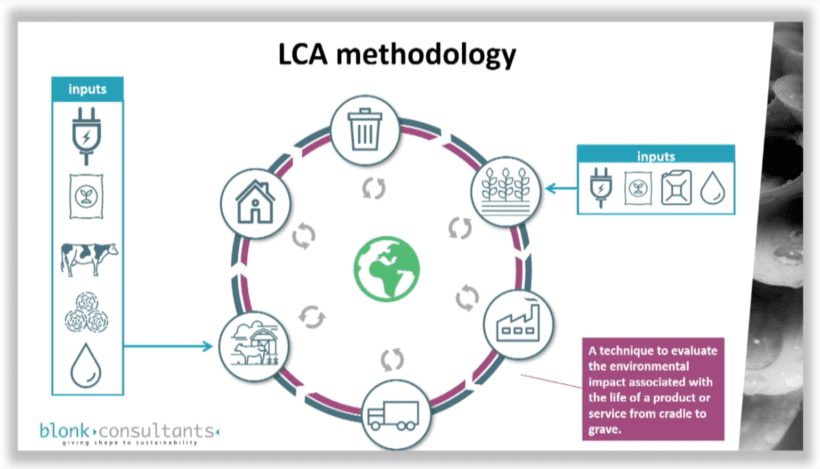

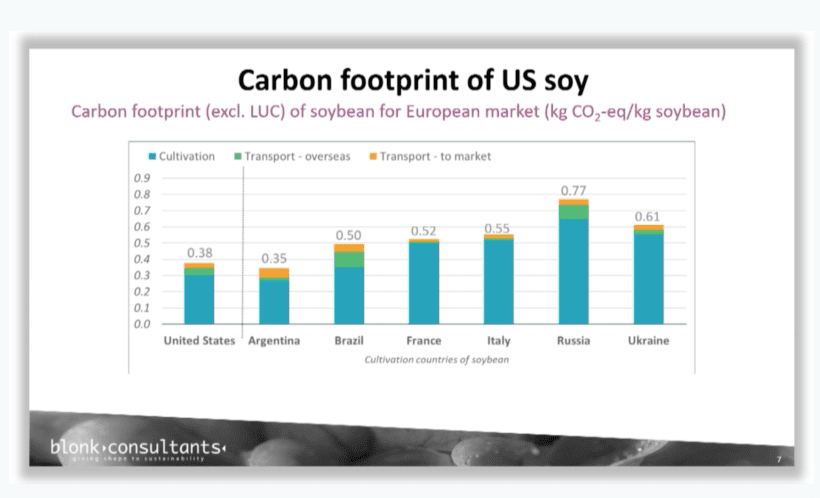

USSEC recently engaged Blonk Consultants to help answer this question: What is the environmental footprint of U.S. Soy compared to other sourcing countries for the European (and other) markets? Blonk compared 1 kilogram (kg) of soybeans, 1 kg of soybean meal crushed at market, and 1 kg crushed in the country of origin, using a life cycle assessment (LCA).

Janjoris Van Diepen, senior consultant at Blonk, presented participants with the results about the carbon footprint of U.S. Soy, explaining the LCA methodology and data and modelling used.

Cultivation, explained Van Diepen, is the major contributor to carbon footprint. In general, the U.S. has higher yields, minimal fertilizer use, and efficient machinery, all of which help to minimize U.S. Soy’s carbon footprint.

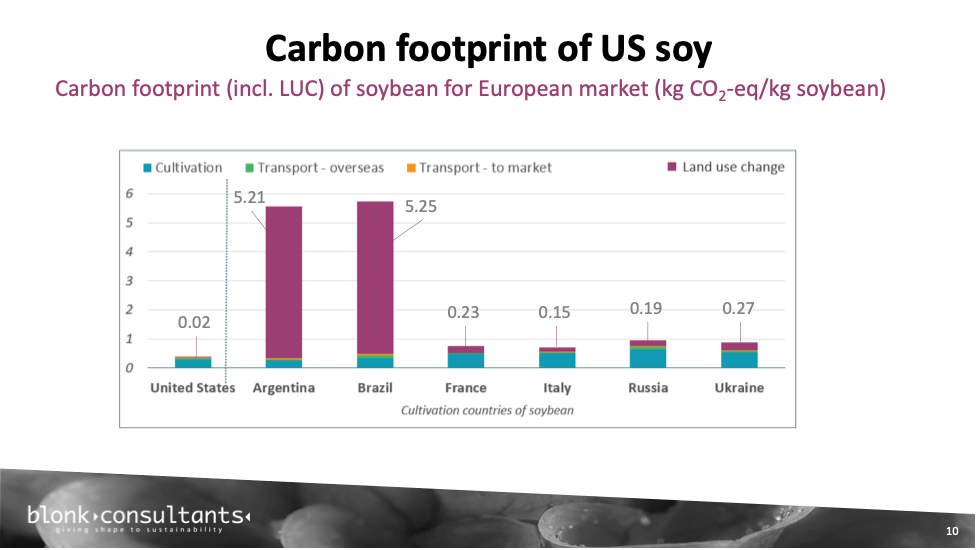

Land use change (LUC), according to Van Diepen, also has a significant impact on carbon footprint. Deforestation in Brazil has had a negative impact on the carbon footprint of the country’s soy. On the other hand, the United States is the number one country in the world for preservation of public forestry lands[1] and since 1935, the U.S. Department of Agriculture (USDA) has encouraged soil conservation programs. U.S. farmers take great care to protect and nurture their land with the intent to pass it to the next generation in even better condition than they received it.

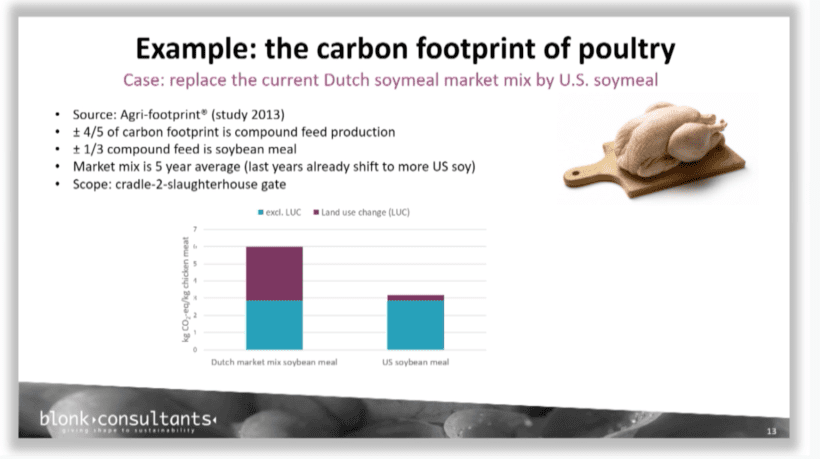

The impact of soy on animal production is another key factor when comparing carbon footprints of soy from different origins. In a case study from 2013, the then-current mix of Dutch soymeal market mix, made up of mostly Brazilian and Argentinian meals, was compared to the carbon footprint of U.S. soybean meal. Since that study was performed, Blonk said, the Netherlands has shifted to a mix with a greater proportion of U.S. soybean meal. “This is just an example to show you the impacts that soy can have on the carbon footprint of animal production,” Van Diepen stated.

Van Diepen concluded that the carbon footprint of U.S. Soy is lower than that of other origins.

Mapping U.S. Soy to UN SDGs

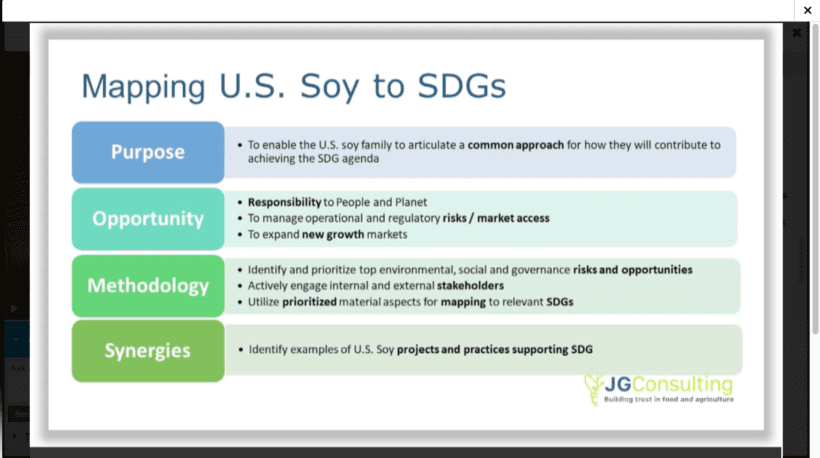

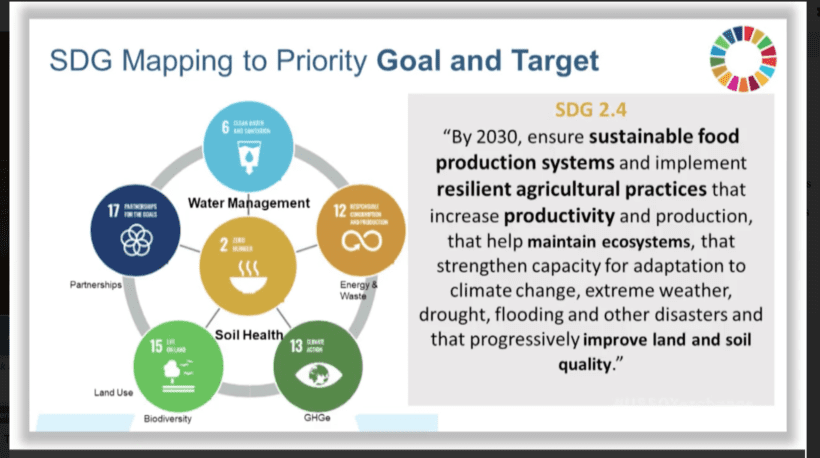

Jennifer Garrett, founder and president of JG Consulting Services, spoke to participants about how U.S. soy’s farming practices support the United Nations’ (UN) Sustainable Development Goals (SDGs). The SDGs are 17 goals that aim to end poverty, protect the planet, and ensure all people enjoy peace and prosperity by 2030. These aspirational goals anticipate 10 billion people by 2050. “Agriculture, in fact, is the thread that connects all 17 of these interconnected goals,” Garrett explained. “Therefore, U.S. Soy as a part of U.S. agriculture is a critical part of this solution.”

SDGs help companies, including food and beverage companies, to strategize their sustainability planning. The SDGs are a common language and a global alignment framework.

“Sustainability can be a market access issue or an opportunity,” stated Garrett. Mapping helps U.S. Soy in three main areas: responsibility to people and planet; to identify how to better manage operational and regulatory risk; and how innovation has been stimulated by these targets, which can help lead to expanding new growth markets. Mapping U.S. Soy to SDGs ensures the U.S. soy industry has a common approach.

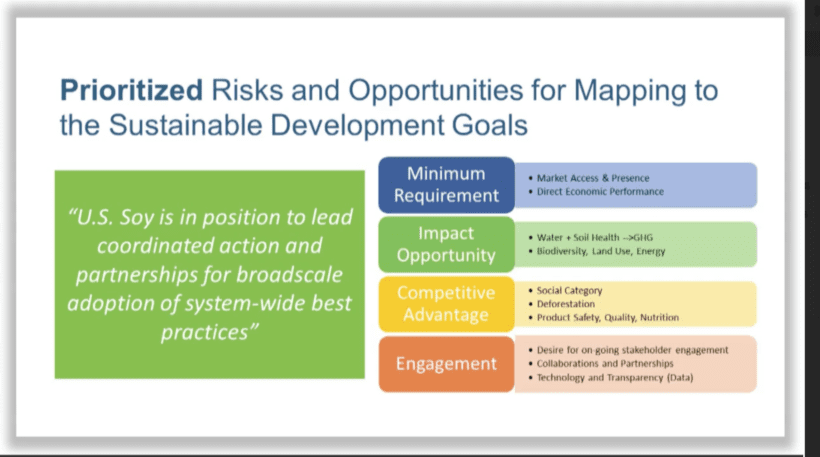

The three top priorities to minimize future risk for U.S. Soy, Garrett continued, are soil health practices, water management practices, and opportunities for greenhouse gas reduction.

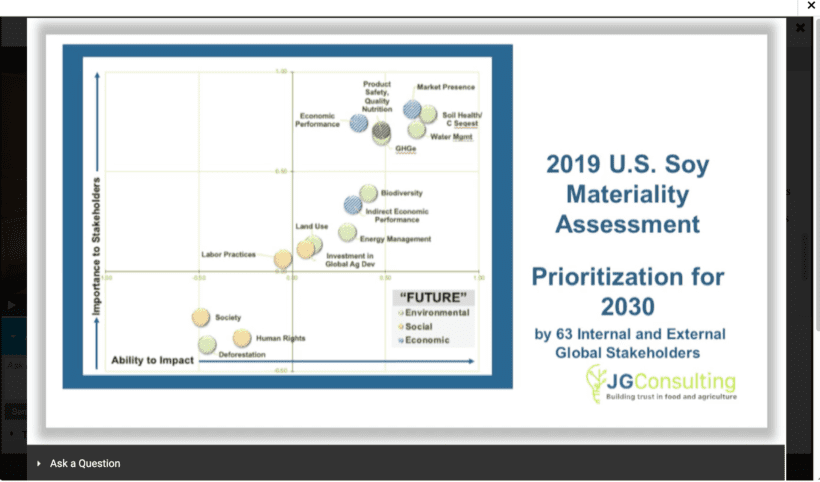

In a materiality assessment, 63 U.S. soy stakeholders identified 15 main issues – environmental, economic, and social aspects – that put U.S. Soy at risk or opportunity. Stakeholders identified risk areas in the environmental area where the U.S. could make even further improvements in soil health, water management practices, and reductions in greenhouse gas emissions. The U.S. already has a set goal to reduce GHG emissions and is striving for continuous improvement in biodiversity, energy management, and land use. In the economic area, market access and direct economic performance will help to implement other sustainability opportunities. In the environmental area, water and soil management practices will positively affect greenhouse gas emissions. And in the social area, the U.S. already enjoys a competitive advantage with labor practices and human rights. The United States is not engaged in deforestation, but rather, reforestation. And U.S. Soy’s quality, nutrition, digestibility, and safety are all competitive advantages that help put U.S. Soy is a position to lead.

This information was used to map to priority SDGs where U.S. Soy could have the greatest impact. SDG 2 - Zero Hunger – was identified as the perfect place where U.S. Soy could help to move the needle and move forward with continuous improvement.

SDG 6 (Water Management), SDG 12 (Responsible Consumption and Production), SDG 13 (Reduce Greenhouse Gas Emissions), and SDG 15 (Life on Land) are connected to Zero Hunger as well and U.S. Soy’s four current goals. The outcomes of meeting these goals contribute to meeting Zero Hunger.

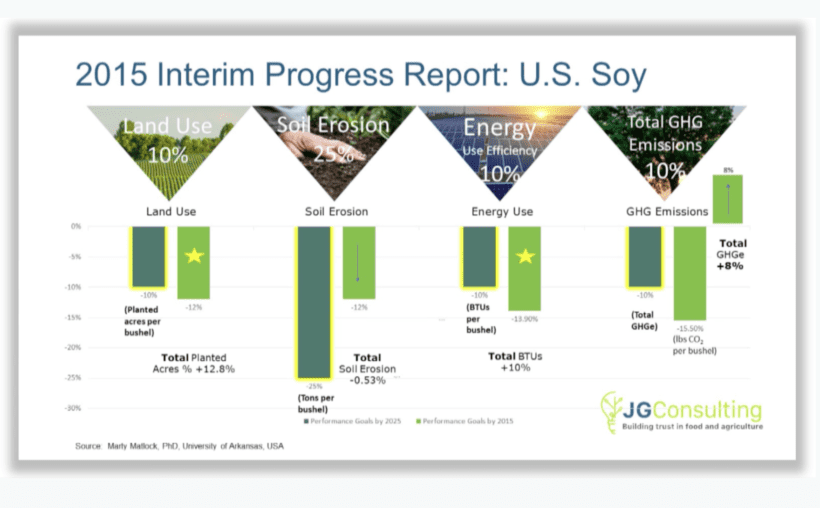

What is U.S. Soy doing now to help support that goal and target? Four goals, identified in 2015, already exist for U.S. Soy: continuous improvement in the areas of land use, soil erosion, energy, and greenhouse gas emissions between 2000 and 2025.

U.S. Soy has made considerable progress towards these goals. The land use goal was already exceeded in 2015; however, the industry is still making progress there. U.S. Soy is about halfway to its soil erosion goal and has exceeded its energy goals. For greenhouse gas emissions, efficiency has already made great progress and the industry is still working towards the total goal.

“We have commitment for continuous improvement,” Garrett summarized.

The Sustainability Advantage of U.S. Soy

Sustainability, once seen as a potential trade barrier, has turned out to be a strong competitive advantage for U.S. Soy. This year, 39.6% of U.S. soy exports valued at $5,016,520,872 this marketing year have been verified sustainable.

The GTE is hosted in partnership by the U.S. Soybean Export Council and the Specialty Soya and Grains Alliance. Held annually, the GTE provides an opportunity for the entire soybean value chain, from farmers to exporters to importers, to connect with each other to create new business relationships.

[1] United Nations Food and Agriculture Organization