Non-GMO U.S. Soy Production Competes with High Commodity Prices

- Category:

- General News

- Reports

While non-GMO soybean demand is on the rise, production is slightly down. According to feedback from exporters, growers and the USDA, the primary reason non-GMO acreage decreased in the 2021 planting season was the very high price of commodity soybeans. The U.S. Soybean Export Council’s (USSEC) latest Non-GMO Food-grade Soybeans Quantification Study explores this trend and what it means for both producers and customers of U.S. Soy.

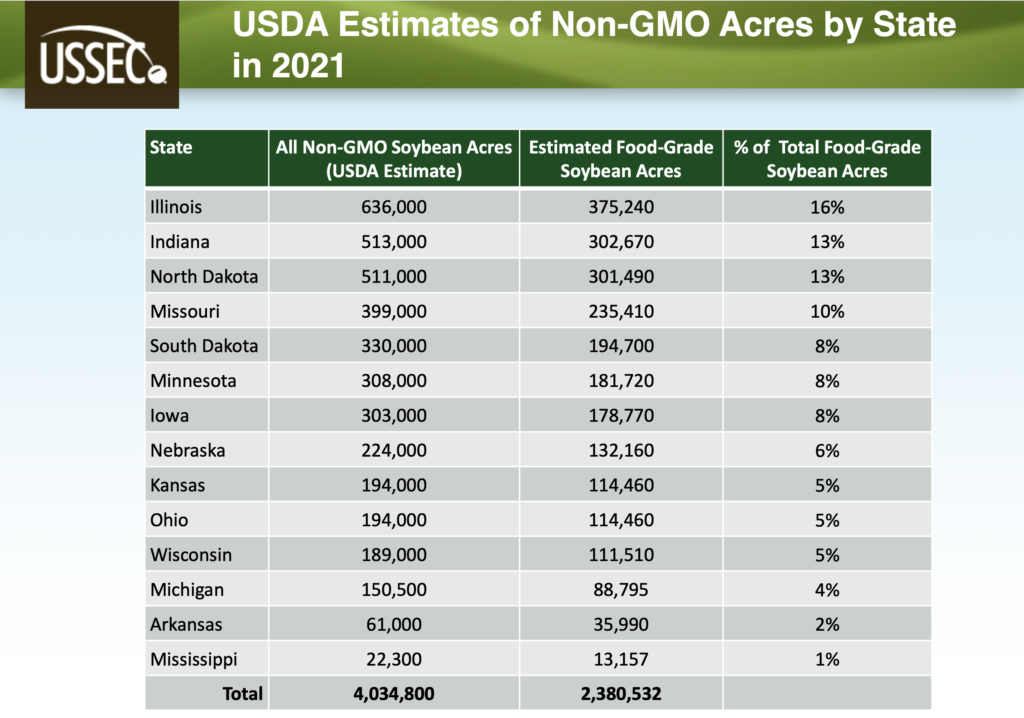

Of the 87.2 million soybean acres planted in the U.S. in 2021, 4.4 million are non-GMO. This is compared to 5 million in 2020 and a projected 4.1 million in 2022. U.S. Soy farmers dedicated around 2.6 million acres to food-grade soybeans, destined for the tofu market, soymilk, miso, natto, sprouts and more. The other 1.7 million acres of non-GMO soy were feed-grade.

Where is IP soy headed? Will McNair, USSEC Director of Oil and Human Protein, shares that non-GMO food-grade soybeans account for about 1-2% of exported soybeans. According to USDA estimates, most are destined for Japan, which is expected to receive 346 thousand MT of non-GMO food-grade soybeans in 2021. South Korea, the second largest importer, is increasing imports each year.

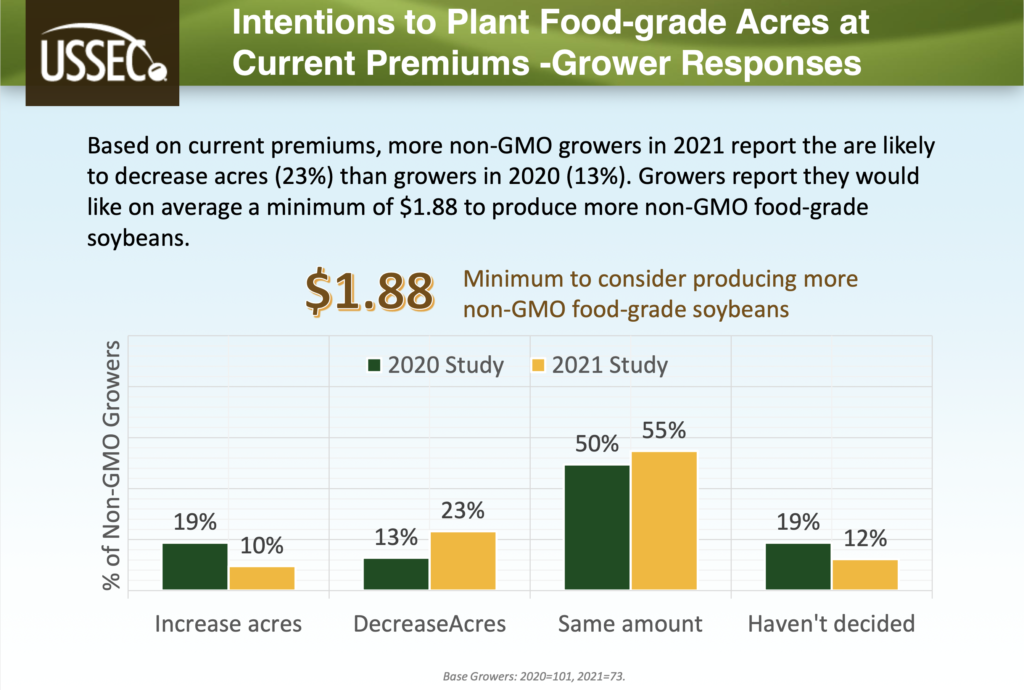

The market is growing, but fewer acres of non-GMO food-grade soy have been planted in the U.S., mostly due to high conventional soybean prices.

“Simply put, it is harder to get the farmer's attention with a $1-$3 non-GMO premium when commodity soybeans are already $15 plus,” one purchaser shared. “However, when soybean prices are in the basement, many farmers need that non-GMO premium just to break even.”

Currently growers report receiving an average farmgate premium of $1.71 for their non-GMO food-grade soybeans. At the time of the survey in spring 2021, many farmers indicated the decrease in non-GMO soybean acres will go to commodity soybean production. Since the interviews were conducted, the price of soybeans has dropped. Anecdotal feedback indicates that non GMO soybeans could be expected to increase in the coming year.

The future growth of non-GMO food-grade U.S. Soy largely depends on lower conventional prices or higher non-GMO premiums. Some farmers would consider making the switch because of future increased herbicide resistance and continuously high non-GMO demand, as well.

These results and more can be found in the 2021 Non-GMO Food-grade Soybeans Quantification Study.

- Partially funded by U.S. soybean farmers and their checkoff.