USSEC Showcases Science Behind U.S. Soy

- Category:

- General News

What many international buyers of soy don’t give merit to is that not all soy is equal. The U.S. Soybean Export Council (USSEC) put that message front and center this morning as industry leaders shared the investments and work being done to change how buyers valuate soy.

“Our biggest market for U.S. Soy has been and will be soybean meal for use in feed rations for animals and aquaculture,” said Monte Peterson, a fourth-generation farmer from Valley City, N.D. and USSEC chairman.

However, U.S. Soy typically has a little higher price than soy from other origins and is a little lower in crude protein levels, said USSEC CEO Jim Sutter. Meanwhile, customers of U.S. Soy for years have said “the chickens know the difference,” or the “the pigs can tell which origin the soy comes from,” he added, nothing that it’s all about the health of the animals and production efficiency.

Sutter explained that a team of nutritionists around the world has gone to work studying the differences among soy from varying origins and developing tools to help bring to light what these differences mean for a business.

He highlighted a meta-analysis done by Gonzalo Mateos, of the Polytechnic University of Madrid in Spain, that analyzed nearly 2,000 samples of soybean meal from around the world and reviewed 18 studies. Sutter also mentioned an investment into data from Evonik, which provides real-time analysis of soy.

What we learned is “not all soybean meals are the same,” Sutter said. “Largely the difference in the quality of the meal has to do with origin.

“This is very important because we needed to showcase that origin truly does make a difference and this meta-analysis brought that to light. Quality is largely dependent on origin, and the U.S. consistently delivers the best quality.”

To help buyers of soy better understand these differences, Sutter said, we had to turn this data into dollars and cents and that’s where the Soy Nutrition Value Calculator comes in.

He explained that this software, developed by Genesis Feed Technologies, incorporates feed formulas that are representative of regional feed manufacturers, is species-specific, and considers that growth stage or development phase.

“Both the nutrient values and prices of all the other components of the diet are also computed in this calculation … it shows them in dollars-and-cents terms which soy they ought to buy. It brings visibility into feed costs.”

Doug Winter, USSEC vice chairman and a soybean farmer from Mill Shoals, Ill., added that having this type of information and to say that “U.S. Soy is backed by science” is very positive.

“Our goal is to continue to make our global partnerships stronger and remain a constant supplier to the soybean industry and our suppliers,” Winter said. “This research only serves to strengthen our position.”

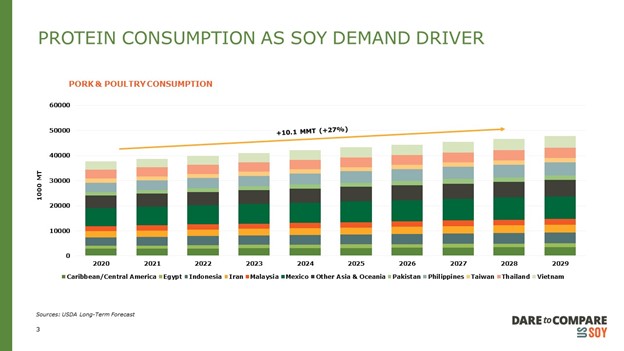

As part of the news conference, Mac Marshall, United Soybean Board and USSEC vice president of market intelligence highlighted key livestock trends and what it means for soybean meal demand.

“We are fundamentally an export business that is underpinned by global protein demand,” Marshall said. “ As we look to the next decade, it’s important to recognize how geographically diverse the centers of incremental protein demand are.

“Over the next decade, global protein demand in many parts of the Middle East, Africa, Southeast Asia and Central America will all experience significant increases in protein demand.”

Where that demand comes from over the next decade will be co-located with where those centers for incremental protein demand are on the pork and poultry side, Marshall explained.

“If we look at projected soybean imports over the next 10 years, we see that grow by almost 30% spread across Southeast Asia, Latin America, North Africa,” he said.

As these regions continue to experience economic improvement and are centers of long-term population growth, Marshall said there will be increased demand for protein – some of which is protein that’s imported from the United States.

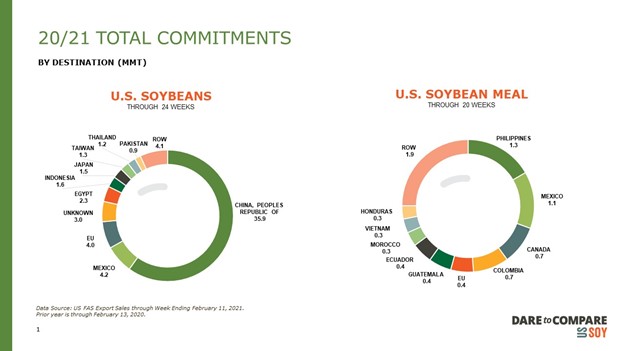

Marshall also recognized the significant role of China, noting that big growth can happen in these other regions.

“A lot of beans are going to China; this has been a fundamental driver for the price appreciation we’ve seen over the last few months,” he said. “But I want you to look at the whole picture and a lot of these smaller markets.

“Once upon a time, China was a small market. If you go back 30 years, it was not even an importer. As we look at some of these other markets that are moving further back on the protein consumption assention curve, that’s what we have to look to for understanding what the future of global soy and soymeal demand is and where the U.S. fits into that picture.”